Welcome!

Interested in us?

Got an email?

Please reply as soon as possible: your answer is important!

Want to talk?

It is always a pleasure to have a chat about wealth preservation!

Want to do like me?

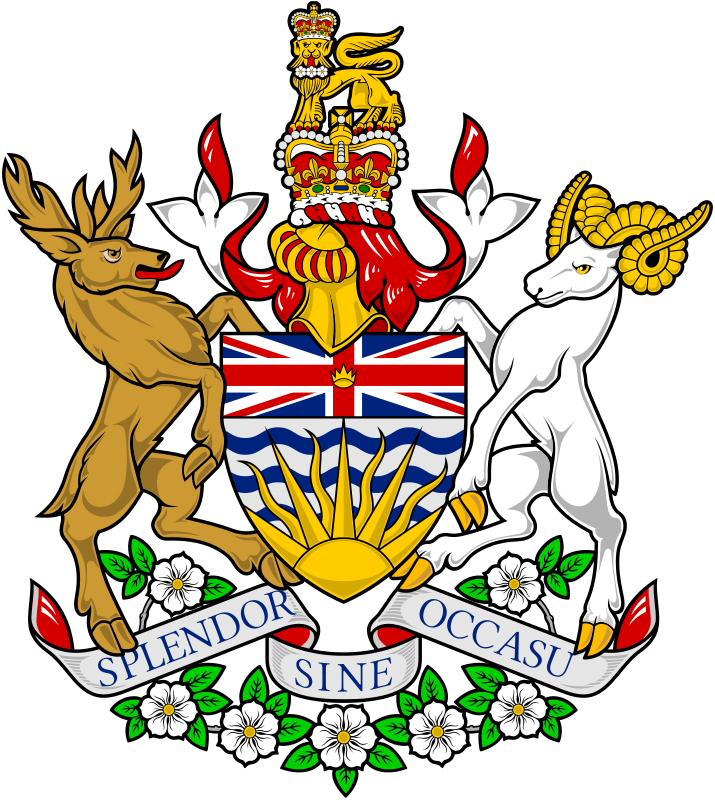

If your are considering investing in precious metals: incorporate in Canada! Click on the icon for my free gift. 🎁

Get in touch?

Email address is:

listen@bluejaymindset.ca

Phone: (+1) 307-222-3777

Registered Address

BLUEJAY MINDSET LLP 7-2070 HARVEY AVENUE

UNIT 288

KELOWNA, BC V1Y 8P8

CANADA

Thankful to British Columbia

Every day I am thankful to the Province of British Columbia to exist and for its ease to do business!

The motto of the Province is : “Splendor Sine Occasu” in Latin, which means: “Splendour without diminishment“.

I have registered BLUEJAY MINDSET LLP on the 25th October 2021.

BLUEJAY MINDSET LLP

My Story

After reading “Crash Proof 2.0″ by Peter Schiff, I have decided to invest in Precious Metals.

What are Precious Metals?

Precious metals are rare, naturally occurring metallic chemical elements of high economic value. Chemically, the precious metals tend to be less reactive than most elements (see noble metal). They are usually ductile and have a high lustre. Historically, precious metals were important as currency but are now regarded mainly as investment and industrial raw materials. Gold, silver, platinum, and palladium each have an ISO 4217 currency code.

What are my favorite Precious Metals?

Gold and Silver!

Member

Precious Metals Live Prices (in USD):

Gold

Silver

Platinum

FAQ

The primary way is to buy the physical commodity (bullion) so coins and ingots. My favorite way is coins. It is also possible to purchase the financial asset which moves along the price of the commodity. This latter way makes it easy to sell and purchase (regardless of the inventory).

Most precious metals bullion in Canada is exempt from GST/HST. Provided the precious metals are defined as coins, bars, ingots, or wafers of gold, silver and platinum. Additionally, they must be refined to a minimum purity of 99.50% for Gold and Platinum, and 99.9% for silver. But there could be a Capital Gains Tax (read the next question).

A partnership does not pay tax on its capital gains or losses and does not report them on an income tax and benefit return. Instead, members of the partnership report their share of the partnership’s capital gains or losses on their own return.